Approximately 4 minutes reading time

Facebook has become a powerful media company without making any content itself, and Uber has built up a strong market position without owning a single taxi. Platforms look like a very smart and lucrative new business model that you can just plug into. But is it also successful in the insurance industry?

Until recently, there was a lot of scepticism about platforms in the insurance industry. Facebook and Uber are great companies, but they are not insurers. The financial world is completely different, or at least that's what people used to think. However, there are very few sectors where the use of data (the fuel that drives every successful platform) lies so deep in the heart of the business operations as it does in the financial world. Not only are we going through the age of digital transformation, the world has also been radically transformed by the COVID-19 pandemic. That is precisely why insurance companies and brokers with digital platforms are ready for the future.

An insurance platform

When we talk about a digital platform (and in this context an insurance platform), what do we mean exactly? The basic principle behind a platform is really quite simple. Back then, supply and demand operated in separate worlds. With a platform, the supply is completely aligned with the demand by not only offering your own products and services, but by working together with partners to supply a range of products and services that meet the demand at an individual level. A platform therefore facilitates an exact match between supply and demand. In this way, the supplied products and services appeal to a much larger target group, and this makes a platform a lucrative business model.

Partners in a platform can accelerate the pace of innovation by working together. Because you are not limited to your own range of products and services, you can take advantage of the strengths of a partner and focus on your core business at the same time (you can't be good at everything).

Faster innovation and lower costs

A digital platform often makes collaboration much easier (especially at CCS). You can collaborate without a platform, but then each partner has to carry the cost of integration and it takes time to get everything up and running. With the digital insurance platform of CCS, the cost of integration is already taken care of, which makes it much easier for an agent to work together with a partner.

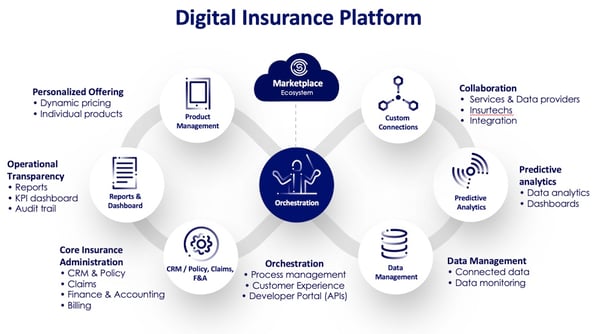

In practical terms, this means we integrate Level (back office) and Marketplace (ecosystem), and then offer it as a single platform to the market. Level supports insurers and brokers with the administration of insurance policies, claims handling, and financial administration. With Marketplace, our customers can use partners who offer specific services and solutions, such as smart apps that enrich the customer experience. Partners who want to join Marketplace can now integrate their application with the platform in just three to six weeks. Our customers can now use the services of a partner that makes apps, for example. This means a customer can roll out its own mobile app to all its customers with just one click of a button, so to speak.

Advantages for the customer

One big advantage of a digital insurance platform is that an insurer or broker can optimise their business in two ways at the same time. Many insurance companies are trying to find ways to make their business operations more efficient, while at the same time improving the service they offer to their customers. With the digital insurance platform of CCS, you can offer combinations of solutions to your customers, for example, by using one of our partners for the handling of simple claims via Straight Through Processing (STP). If the claim is not covered, and thus can't be handled via STP, then there are other partners who can help with the facilitation of the best loss recovery options. In this way you can optimise the customer experience, improve operational efficiency, and combine data in a way that has direct benefits for your customers.

A lot more management information

The integration of Level and Marketplace unlocks a wealth of useful management information. All the data you collect in Level can be combined safely and efficiently with data from other business applications, such as financial systems or CRM systems. This allows you to identify complex relationships. For example, the relationship between marketing campaigns and the profitability of certain products.

Now is the time to start innovating. Insurers and brokers need to start looking ahead to the future. Although the need for innovation is definitely recognised within the industry, many people are put off by the costs involved and the complex technology. That is why plugging into an existing digital platform is a very attractive option. You don't need to have the financial resources of Facebook or Uber to make that happen. The solution is right there for the taking.