Approximately 5 minutes reading time

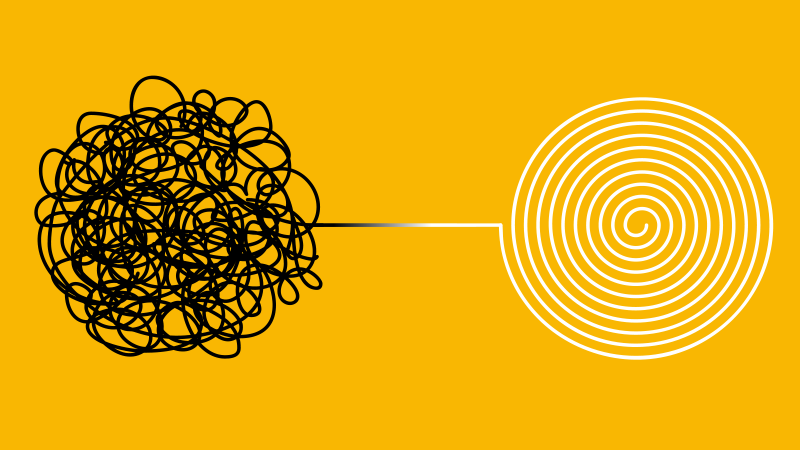

There is a huge imbalance in the insurance world. Innovation, and the expectations it brings with it, is at odds with today's (IT) reality. The situation is confirmed by Gartner who report that the biggest cost item for CTOs is still legacy system maintenance. Insurers struggle with the capacity to implement processes and product modifications quickly and, as a result, innovation hardly gets off the ground. The gap between legacy and innovation needs to be closed, but the question is: How’s that done?

A Flexible Solution for Process Management

The real answer is, there is no simple solution. Insurance processes are complex and so is the IT landscape that has emerged over the past decades. Creating a workflow for acceptance, for example, or adjusting a business rule is often a time-consuming affair. Alternatively, imagine that you want to outsource part of the claims process to a partner who determines the amount of the claim digitally. In such a situation, it is difficult to link this information back to the process defined in the back office. A link is needed and this rigid process needs to be adjusted. These are not easy changes to make and they threaten to hinder innovation, unless the right approach is adopted.

An important step towards a solution is the introduction of a flexible process management solution. Processes should not be changed in the back office, but rather extracted from the back office. After all, the back office makes it difficult to modify the processes, so you need a different approach.

Flexible process management is only possible if the back office is viewed from a different perspective. From a technical point of view, it makes sense to transform the back office into a system of records. In other words, a ‘card index box’ from which most intelligent data (such as acceptance workflows and business rules) has been extracted. New process management techniques ensure that processes can be accessed and adapted through a visual user interface. Rigid processes that used to be housed in a back office are now represented in an instant, visual display. This provides insight into how processes are set up and with a good BPMN tool the business can implement changes itself. But, we're not quite there yet. What’s especially interesting is if predefined insurance processes are present in the BPMN tool. Then the business does not have to build everything from scratch. This results in considerable time and cost savings.

In data analysis, for example. If it turns out that the application flow converts better in a different way, the flow can easily be adjusted by business employees, without affecting the administrative process of applying for insurance.

Uniform Data

Before a BPMN tool can be used, the data must be retrieved from the back office. This often presents a challenge. It seems almost an accepted phenomenon in the insurance world that systems and data are developed in closed silos. It’s difficult for systems to 'speak' to each other and data is often difficult to access. In recent decades, this has resulted in point-to-point integrations, creating a kind of spaghetti infrastructure. This results in a difficult to fathom landscape of systems that are linked one by one. It is obvious that this is an enormous hindrance when trying to introduce new technologies or when making changes to, for example, an acceptance process.

Data and systems must therefore first be liberated from the silos, which requires effective and efficient data integration. Due to the complexity involved, a phased approach is required. Each system often has its own philosophy about how data should be stored. Mapping data together is a difficult and time-consuming task. Any type of integration project that uses disparate data needs to have the ability to normalize input data.

The ACORD data model is an important means for many insurers to achieve uniform data. All data is translated to the same internationally recognized insurance standard. As a result, the systems are able to 'talk' to each other. Only through this method can the integration process be simplified and uniformity ensured.

With uniform data and flexible process management, a whole new world is created. First and foremost, all data speaks the same language, allowing the maximum potential to be tapped. Think, for example, of the simple bundling of products using data from two different back offices. In this case, the described approach avoids rigid back office processes because changes are carried out in a flexible BPMN tool. Premium adjustments or, for example, adjusting a business rule for a specific target group, become a lot easier. In short, the gap between the expectations of innovation and the IT reality of today can be closed. But, it is not easy. A step-by-step approach is required to ultimately realise the dream of tomorrow.