Approximately 6 minutes reading time

Recent studies carried out by Gartner and Accenture, among others, have shown that insurance companies are becoming more digitally mature. It is a step in the right direction, but not a genuine transformation, which is why many product innovations or new business models are still based on outdated concepts.

"Insurance companies are still primarily focused on automating and optimising their internal processes. A significant proportion of the insurance offerings are still based on the idea ‘one size fits all’. Insurers who are further down the transformation road (around 48% of the market) are now introducing marginal client segmentation in their product range. However, the transformation has not gotten as far as ‘connected services’ and ‘real-time insurance’. There is still a lack of genuine innovation, and it is easy to understand why", according to Oliver Huber at CCS.

Changing markets

Digitisation has led to a drastic change in consumer behaviour. Internet giants like Amazon, Alibaba, and Rakuten made sure of that. Their motto: ordered today, delivered tomorrow. They might be e-commerce organisations, but the way they do business has also caused consumers to have different expectations about their insurers. Insurance companies are going through a process of transformation, but not fast enough. There are two reasons for this:

- The traditional method of developing and selling products is still very profitable;

- The existing core systems are very complex and were not designed with a digital transformation in mind.

Nonetheless, innovation is critical. New players are emerging in the insurance market and will play an important role. Lemonade and One Insurance, for example, have disrupted the market by ignoring traditional business models and by setting the standard for digital services. Should digitisation not have sunk in yet, then they have made it clear that digitisation has to be made a top priority.

Complex IT landscape, big challenges

The digital transformation does not mean the existing core systems have to be replaced. That is a simplistic idea that totally overlooks the complicated IT landscape that insurers have to operate in. Sometimes several core systems are used, and data is not stored centrally but in different departments. Furthermore, the replacement of a core system means the insurer can not start innovating until the implementation of the new system has been completed. The following challenges can also make the transformation process difficult:

- Insurers often have no control over the information that is stored in the core system;

- They are afraid of not being in (full) compliance with all the applicable laws and regulations;

- They do not have a complete overview of all the relevant customer and product data that they have on file;

- Product modifications are difficult to implement because they are ‘hard coded’ and it takes a lot of IT effort to modify that. The time-to-market is therefore too long.

The above problems not only have to be overcome in the IT department, but also in data analytics, marketing, and sales. Otherwise, as Accenture put it, insurers will be trying to build new digital offerings with playbooks from the past. And this will make genuine innovation impossible.

Digital Insurance Platform

The answer of CCS to these challenges might surprise you. You don't have to make any changes to your existing IT landscape right away. Rip and replace is not the answer to the challenges and it does not accelerate the digital transformation. What does help is if the existing systems become ‘systems of records’. You then add a platform that integrates and harmonises everything, and at the same time enables you to integrate external data and partner solutions.

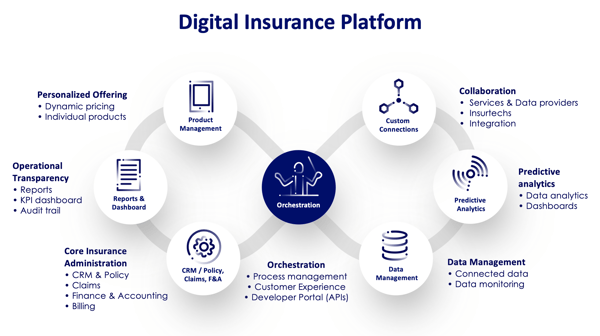

CCS offers a digital insurance platform that makes it possible for insurers and brokers to continue using their existing core systems, to utilise and access their existing data centrally via the digital platform, and to start competing at the top of the digital insurance market right away. The platform integrates software, services and a partner ecosystem in a way that instantly enhances your insurance business. A single version of the truth is generated on the basis of your existing core system, and you can start innovating right away.

The rich integration platform comes with built-in knowledge of insurance practices and standard industry processes based on CCS‘ 35 years of experience in the insurance industry. It is a true “plug-and-play” environment that can be used straight away.

In addition to the optional support for core insurance processes, such as policy administration, claims handling, and billing, the platform has extensive orchestration capabilities for end-to-end management of the insurance value chain. This means the platform covers the entire lifecycle of insurance policies - from digital contact with the customer, the optimisation of core activities, to the enabling of predictive analytics. With the CCS Digital Insurance Platform, you can coordinate internal and external data sources and services using the product configuration features and the dynamic user interface.

The platform enables the quality of existing data to be enhanced through the application of industry standards. This is the key to genuine innovation.

Victor Insurance Germany

The digital insurance platform is a robust, scalable and proven digital insurance platform with support for end-to-end processes and omnichannel orchestration. That is why the world's largest MGU Victor International, part of Marsh and McLennan Companies, decided to choose the digital platform last year. Within only four months, they were able to develop and launch a new cyber insurance product called CyberVlex, which included the integration with their partners in the German market.

Victor Insurance has the ambition of becoming the InsurTech MGU of the future. It was to be big and international, but agile and flexible at the same time. This ambition is founded on years of experience in the insurance sector and a focus on innovation. The digital insurance platform of CCS will play a key role in the realisation of this ambition. Victor’s expertise lies in evaluating risks and developing risk management solutions for clients, as well as the use of innovative technology for the distribution of specialty insurance products through a large network of agents and brokers.

The IT landscape of Victor is complex, just like every other insurance company or large international broker. Nonetheless, by working together with CCS they were able to break through the paradigm that innovation is slowing down. The most important lesson for insurance companies, therefore, is that the existing IT landscape does not need to be replaced. If that happens, it will only slow down the pace of digital transformation and innovation. Innovation goes faster when the existing IT landscape is consolidated and integrated in a digital insurance platform.