Approximately 6 minutes reading time

In an era where we live and breathe digital transformation, insurers are at the forefront, transforming their businesses into digital powerhouses. While the majority are still focusing on internal process optimization, there is a minority who are going next level with data.

The potential of data is enormous, but, to leverage on data, insurers need data scientists or smart tools to make it work. To make effective use of data, it is important to understand the business, build relevant datasets and, of course, you need the right analytics and decision modeling skills. If you combine all of this, you have the right tools in place to leverage on your data. So, let’s dive into the frontrunners’ world and discover the top 6 data science use cases in insurance.

1. Automated Insurance Fraud Detection

Detecting fraud is not only vital in preventing financial losses, it is also an important service to society as a whole. And yet, there are insurers whose approach to fraud detection continues to rely exclusively on the gut feeling of the claims adjuster, typically resulting in excessively high costs. With the rise of big data and greater access to external data to enrich investigations, it is time to move on from the claims adjuster’s gut feeling to a more data-driven approach, not forgetting the side benefits - huge time savings and significant process optimization.

Fraud detection platforms make it possible to detect fraudulent activity, suspicious links, and subtle behavior patterns using multiple techniques, like text mining and image screening. To make automated fraud detection possible, the algorithms should be fed with a constant flow of data. This data comes from internal records of previous cases of fraudulent activity or external fraud pools with sampling methods applied to analyze them. Predictive modeling techniques are also applied here, for the analysis and filtering of fraud instances. Identifying links between suspicious activities helps to recognize fraud schemes that had previously gone undetected. Ultimately, insurers who make use of these platforms will end up substantially reducing the level of fraudulent claims, thereby making significant savings.

2. Dynamic Pricing in Insurance

The time-honored principle of the insurance industry is the concept ‘solidarity’. Yet in a world full of data and high-quality techniques, risks can increasingly be assessed on an individual basis. Price optimization is a complex process. Not only should your core system be able to deal with price optimization techniques (like dynamic pricing), legal controls should also be in place to ensure compliance with changing regulatory demands.

Price optimization uses numerous combinations of various algorithms and methods. The process involves drawing insights from non-actuarial, big data (data not related to the traditional analyses of costs and risk) to determine premiums based on how much a customer is willing to pay for what you, the insurer, has to offer. Price optimization uses numerous combinations of various algorithms and methods. The process involves drawing insights from non-actuarial, big data (data not related to the traditional factors such as risk characteristics or predicted cost of claims and expenses). Thus, price optimization is carefully aligned to the customers’ price sensitivity. Special algorithms give insurers the opportunity to adjust the quoted premiums dynamically. A long term benefit of price optimization is an increase in customer loyalty. Along with this, comes the maximization of profit and income.

3. Customer Lifetime Value

Data scientists are able to gain greater insight into what a customer is really worth, not on the basis of a one-off transaction, but based on the total 'life span' of the customer. Calculating a customer’s lifetime value, gives insurers insight into how much time and money is required to invest in acquisition and provides an unambiguous KPI, enabling more effective management of customer retention.

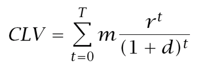

The customer lifetime value (CLV) represents the value of a customer to a company in terms of the difference between the revenues gained and the expenses paid, projected into the entire future relationship with a customer. If you are more into equations, the CLV is determined by:

m = margin | r = retention rate | d = discount rate | T = time

Let’s face it - every customer loves a one-stop shop. So, if someone wants to insure their car at your company, it’s also likely that person needs household and liability insurance. So, this is what it means for you: If a person insures their car, their customer lifetime value is not only the revenue from that car insurance, but also the revenue from other products (weighted by the possibility that the person actually purchases household and liability insurance from you too). Of course, we understand that, in some cases all good things come to an end. People switch to other insurers, so in your equation you should also take into account that some customers may leave. If you combine all of this, you have quite a solid base from which to determine the customer’s lifetime value.

The CLV is of utmost importance to all insurers, not only for the financial analysts, but also for claims adjusters, underwriters and customer service personnel. Rising customer expectations can be managed pretty well, just by looking at their CLV. If someone files a claim, it may sometimes be beneficial to give them the benefit of the doubt, based on their CLV.

4. Next-best Offer

As with any business, growth is a major focus area for insurers. It is quite beneficial to understand what kind of offer you have to make to your current customers to keep them, as it is far more expensive to acquire new customers.

Of course, not every customer is the same, and not every customer has the same combination of insurance products. Yet, data scientists are able to discover common trends amongst your customers. For instance, almost every customer around 30-35 years of age has liability, car and home insurance policies. So, a customer around 30 years of age with only liability and car insurance would also be likely to insure their house with the same company. And as, based on big data, you already know what their home insurance needs to cover and at what price, you can determine, quite accurately, the offer you should make. Obviously, this is a very simple example, but big data enables you to discover hidden trends.

The ‘next-best offer algorithms’ use special filtering systems to spot the preferences and idiosyncrasies of customers’ choices. The algorithms include analysis of data gained from simple questionnaires concerning demographic data and some personal information regarding the insurance experience and the insurance object. On the basis of these insights, the engines generate more targeted insurance propositions, tailored for specific customers.

5. Automated Risk Assessment

An automated risk assessment tool helps you to know your customer (KYC), conduct proper customer due diligence and investigate the risk a customer wants to insure. Implementation of risk assessment tools in the insurance industry assures the prediction of risk and limits it to the minimum in order to cut losses.

For insurers, proper risk assessment is a time-consuming process, as you are not only focused on what to insure but also who you are insuring. An automated risk assessment tool helps you to access internal and external data real-time. Based on your risk appetite, backed by proper data, the risk assessment tool helps you to make instant decisions. This not only boosts your digital transformation, it also enhances the customer experience since the customer can ascertain, in seconds, whether or not the insurance policy has been approved.

6. Claims Automation

Claims automation solutions provide one of the best opportunities for insurers to differentiate themselves from the competition and to potentially engage their customers for life. From the first notice of loss to settlement, claims automation solutions can help insurers to optimize claim workflows, thereby saving time and creating stronger connections with policyholders.

P&C insurers are heavily focused on assessing damage estimates for a given claim. The assessment is often based on information from multiple sources - emails, various paper-based or PDF forms, such as damage estimates or police reports. In such cases, an AI algorithm can be trained to accurately gather the right information from each document.

Once the claim information is organized, robotic process automation (RPA) and artificial intelligence (AI) can be used to analyze the data. It determines whether the policyholder has the right coverage. If a claim is screened and found to be a low risk, it may be authorized for immediate payout or, if it’s more complex, triaged to an adjuster. If a high-risk claim is identified, it is sent directly to a special investigation unit for further review

Conclusions

Data is deeply rooted in the insurance sector. Nevertheless, making effective use of it is a big challenge for many insurers. But, the future is bright, and a close examination of the 6 Data Science Use Cases in Insurance gives us high hopes about what will be seen as common sense in tomorrow’s world of insurance. The frontrunners in the insurance industry are busy automating their fraud detection and claims, focusing on growth (dynamic pricing, CLV, next best offer) and positively transforming the customer experience.